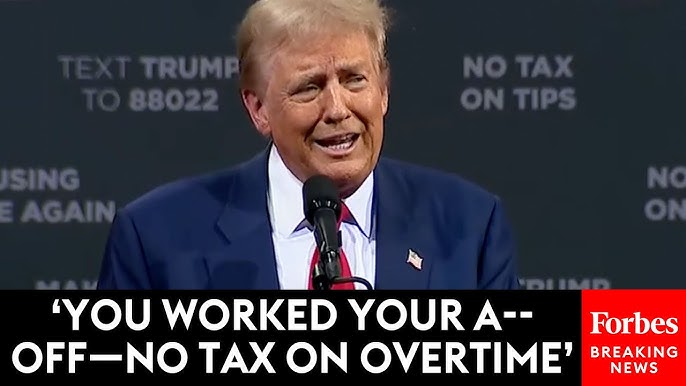

The topic of no tax on overtime pay has long been a subject of debate in the workplace, but one of the most common questions employees often have revolves around the issue of taxes. Does overtime pay get taxed? Or is there such a thing as “no tax on overtime”? This article will walk you through the intricacies of overtime, tax implications, and how workers can navigate this important aspect of their paychecks.

Understanding Overtime Pay and How It’s Calculated

no tax on overtime pay refers to the additional compensation workers earn for working beyond their standard work hours, typically in excess of 40 hours per week. According to labor laws, employees must be paid at a higher rate for these extra hours—commonly 1.5 times their regular hourly wage. However, not all employees are eligible for overtime pay. Exempt employees, such as some managers or high-level professionals, are not entitled to overtime benefits.

The calculation of no tax on overtime pay can get tricky, especially when factoring in things like hourly rates, salaries, and potential deductions. For non-exempt employees, overtime pay is calculated by multiplying their regular hourly rate by 1.5 for every hour worked over 40 hours per week. For instance, if an employee earns $20 per hour and works 50 hours in a week, their overtime pay will be calculated at $30 per hour for the extra 10 hours worked.

no tax on overtime pay provides an incentive for employees to work extra hours, but it also helps businesses comply with fair labor standards by ensuring that workers are compensated properly for their time. Despite the extra pay, many employees wonder if there is an exemption when it comes to paying taxes on these additional earnings.

The Basics of Taxation on Overtime

The short answer to the question of whether there is no tax on overtime is no. Overtime pay is still subject to taxation just like your regular salary or hourly wage. Both federal and state taxes will apply to the extra income earned from no tax on overtime hours, and employers are required by law to withhold the appropriate taxes from your overtime pay.

In fact, because no tax on overtime pay is often taxed at a higher rate due to the additional income, it can create confusion for workers when they receive their paychecks. The amount of tax withheld on overtime pay is typically based on your overall income, filing status, and the tax withholding allowances you’ve chosen. If you’re paid overtime frequently, it’s essential to be aware of how this will impact your overall tax situation at the end of the year.

It’s important to remember that taxes on no tax on overtime are progressive, meaning that the more you earn, the higher the tax rate on that income. no tax on overtime pay is added to your regular paycheck and taxed accordingly based on your total income. However, some workers may experience a temporary increase in their tax withholding when they receive overtime pay, leading them to believe that their overtime is being taxed more heavily.

How Overtime Is Taxed: A Closer Look at Withholding

When it comes to taxes on overtime pay, no tax on overtime understanding how withholding works can clarify a lot of confusion. Your employer withholds taxes from your overtime pay just like they do from your regular pay. However, the way that these taxes are withheld can make it seem like you’re being taxed more heavily on your overtime hours than on your regular wages.

no tax on overtime pay is taxed using the same withholding system as regular pay, but it’s often treated as a “supplemental wage.” The IRS defines supplemental wages as compensation that is in addition to an employee’s regular wages. This includes overtime pay, bonuses, commissions, and other forms of supplemental income.

The IRS allows employers to either withhold taxes on no tax on overtime pay at a flat rate or based on your regular withholding allowances. The flat-rate withholding method involves withholding a specific percentage of your overtime pay, which is set by the IRS at a rate of 22% for federal taxes. However, if your employer withholds taxes based on your regular withholding allowances, the total amount withheld could vary depending on your overall income, tax bracket, and other factors.

It’s important to note that while no tax on overtime pay is subject to tax, there is no separate tax category for overtime earnings. Overtime income is simply added to your regular wages and taxed accordingly. The only difference is that, because overtime pay is often higher than regular pay, it can push your total income into a higher tax bracket, causing your effective tax rate to increase temporarily.

The Myth of No Tax on Overtime

There is a common misconception among employees that there is some form of “no tax on no tax on overtime ,” which likely stems from confusion over how overtime pay is taxed. The idea is that because overtime is paid at a higher rate, it should be exempt from taxes in some way. Unfortunately, this is not the case. The tax laws are clear: all income, including overtime pay, is taxable.

However, this myth can arise because of the way overtime pay is sometimes structured in paycheck calculations. While taxes are withheld on overtime pay, the withholding might not always be clearly communicated, leading workers to believe that their overtime earnings are not being taxed. This confusion is further exacerbated by the fact that overtime pay is typically withheld at a higher rate than regular wages.

For example, if you receive a substantial amount of overtime pay in a particular pay period, you may notice that your paycheck shows a higher withholding amount than usual. This can make it appear as though your overtime pay is being taxed more heavily or that there’s some exemption in place. The reality is that your overtime pay is simply being taxed in accordance with the same rules that apply to regular income, and any differences in withholding are due to the progressive nature of tax brackets and your overall income.

Potential Exceptions and Special Circumstances

While there is no such thing as “no tax on overtime,” there are a few circumstances that could lead to reduced taxes on overtime pay. For example, certain tax credits, deductions, or benefits might apply to lower your overall taxable income, which could result in less tax being owed on your overtime earnings. Below are a few potential situations where your overtime pay may be subject to different tax treatment.

- Tax Credits: If you qualify for tax credits such as the Earned Income Tax Credit (EITC), these credits could reduce your overall tax liability, including on your overtime pay. The EITC is designed to help low- to moderate-income workers by reducing the amount of taxes they owe.

- Retirement Contributions: If you contribute to a retirement plan like a 401(k), those contributions are deducted from your taxable income, which could reduce the tax liability on your overtime pay. This is because retirement contributions are made on a pre-tax basis, meaning they lower your overall taxable income.

- State and Local Taxes: Some states have different rules regarding taxation on overtime pay, and in certain locations, there may be exemptions or reductions in how overtime pay is taxed. However, these exceptions are rare, and most workers will still be required to pay state and federal taxes on their overtime income.

While these exceptions might reduce the tax burden on your overtime pay, they do not eliminate it entirely. It’s important to keep in mind that most workers will still be subject to federal and state taxes on any overtime earnings, and the withholding on these payments will vary based on individual circumstances.

How to Minimize the Tax Impact of Overtime Pay

If you regularly work overtime and are concerned about the tax impact, there are steps you can take to manage your withholding and minimize the potential tax burden. Here are a few strategies to consider:

- Adjust Your Withholding: If you consistently earn a significant amount of overtime pay, you may want to consider adjusting your tax withholding to account for the additional income. By increasing your withholding allowances, you can ensure that more taxes are withheld from your paycheck, which may help reduce the impact of the higher tax rate on overtime earnings.

- Maximize Retirement Contributions: Contributing to a retirement plan, such as a 401(k), can reduce your taxable income and help offset the taxes on overtime pay. Consider taking advantage of any employer-sponsored retirement savings options to lower your overall tax liability.

- Tax Planning and Deductions: Work with a tax professional to explore available deductions and credits that may apply to your specific situation. For example, deductions for mortgage interest, student loan interest, or medical expenses could help reduce your taxable income, lessening the tax burden on overtime pay.

- Monitor Your Total Income: If you anticipate earning a significant amount of overtime in a given year, keep track of your total income and potential tax bracket. By planning ahead, you can avoid any surprises when it comes time to file your tax return.

Conclusion: Navigating Taxes on Overtime Pay

While the idea of “no tax on overtime” is a common misconception, the truth is that overtime pay is subject to the same taxation rules as regular income. Understanding how overtime pay is taxed can help you make more informed decisions about your finances, especially if you regularly work extra hours.

By keeping track of your income, adjusting your withholding, and taking advantage of tax-saving strategies like retirement contributions and credits, you can effectively manage the tax implications of overtime pay. Ultimately, while you may not be able to escape taxes on overtime earnings, a little bit of proactive planning can go a long way in reducing your overall tax burden.